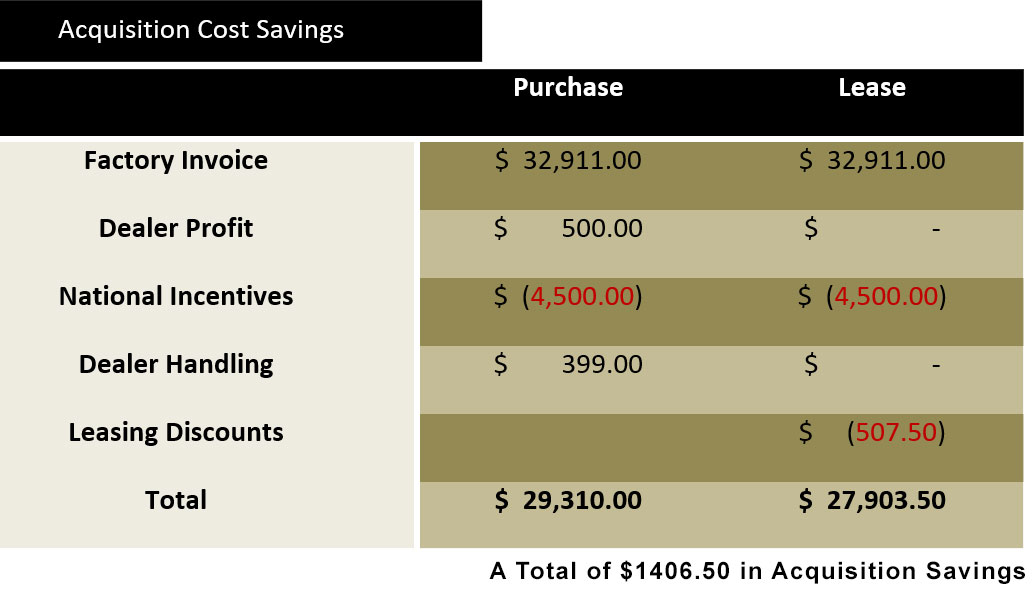

The company achieved a $4,956.19 savings by leasing vs. paying cash for this truck.

Additionally, the company was able to acquire the needed asset without using their own cash and without tying up their line of credit

Alliance Leasing ran a customized cash-flow analysis with the following parameters: